Oil low price unleashes an unprecedented crisis

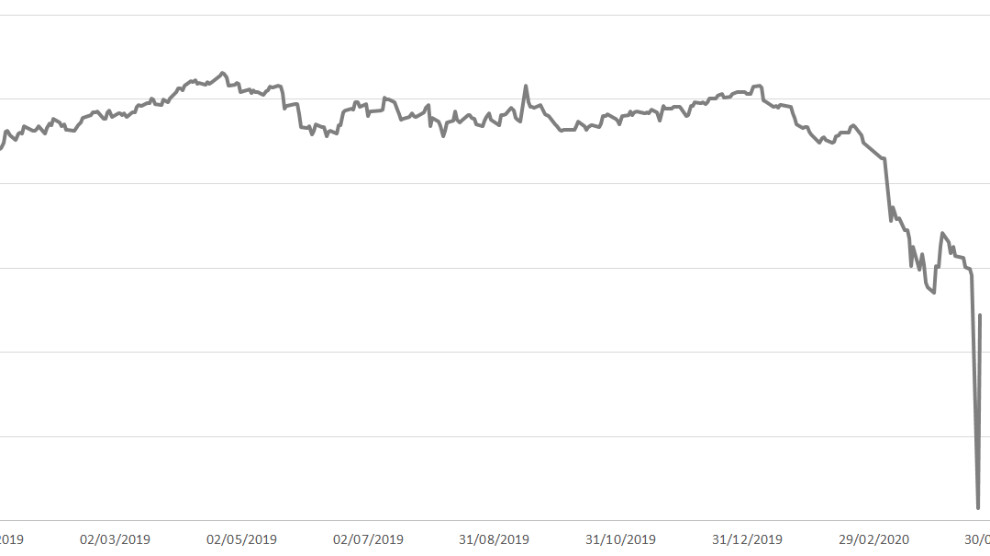

The sharp drop in international demand for oil, as a result of the international coronavirus pandemic, has been compounded by congestion in storage capacity.

The sharp drop in international demand for oil, as a result of the international coronavirus pandemic, has been compounded by congestion in storage capacity.

The agreement reached two weeks ago, in the OPEC + Russia, and prompted by pressures from the President of the United States, to cut production by almost 10 million barrels from May, was followed by Trump's statements that the US would contribute to a further drop in production.

However, the sharp drop in international demand, as a result of the international coronavirus pandemic, has been compounded by congestion in storage capacity, which is why the announced reduction in oil production is still a long way from stabilizing prices in the market.

Thus, last Monday, 20 April, the Texas-type oil, a benchmark in the US, experienced the unusual situation of trading at less than $ 40 a barrel, that is to say: one almost had to pay in order to sell and transport it.

Trump's promise that the US Government would fill all its strategic storage capacity led to a positive return for the Texas barrel by Wednesday, and the European benchmark Brent rate saw its price rising slightly.

In any case, the average price of crude oil at the weekend barely reached $ 20 per barrel, so all producing countries, without exception, extracted their crude oil at a loss and no longer had the capacity to store it.

According to specialists, the current conditions are far from changing in the short term, which is why they point out that the first bankruptcies of the current system should occur in the North American companies that produce crude oil through the controversial method of fracking, which has the highest extraction cost, which which could entail a strong chain of financial failures in North American banks.

The short-term solution, to avoid a chain of bankruptcies, seems to pass through a possible intervention by the North American government, as a rescue of the three big private fracking companies.

A state intervention that would not only contravene the neoliberal policy that the US advocates, but would also have a difficult financial cost to calculate and limited sustainability, given that the conditions of the international market, as well as the demand, still seem very far from recovering some 'normality'.